Estate litigation disputes are unfortunately quite common in Canada. They occur when someone takes issue with the way estate administration tasks are being handled by the executor, such as the division of personal assets.

We anticipate that estate disputes will only become more frequent as our population in Canada continues to age. By the year 2031, 23% of Canadians will be over the age of 65 – almost 10 million people.

Are you prepared to be an executor? It’s a role most people will have to undertake in their lives.

What is Estate Litigation?

The Executor is both legally and financially responsible for any legal action or estate litigation brought against the estate. For example, if a family member has been left out of the will and they take you to court for their right to an inheritance.

If you don’t have Executor Liability Insurance, paying for the legal costs and outcomes of the estate battle will be out of the executor’s pocket. Estate battles are also known to drag on, and the end bill can be damaging. In one recent case, a Toronto Executor was in a 7-year long battle and had to pay over $1 Million dollars in the end.

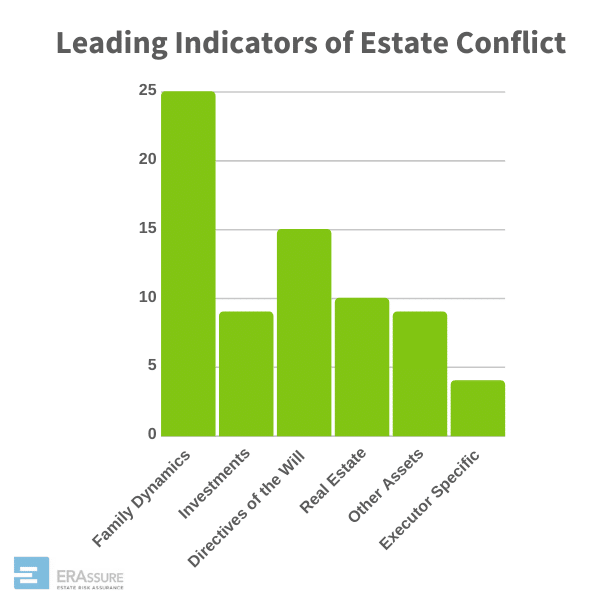

Of course not all estates end in a dispute, but there are certainly some red flags we have learned to identify over our years of assisting Canadian Executors.

Common Estate Litigation Disputes

This is not a complete list of estate litigation disputes as there are so many different situations out there, but many professionals agree we’ve seen the following causes come up most often.

1. Will Discrepancies

Wills that don’t reflect the reality of the family situation are one of the leading causes of estate litigation disputes. This is usually the result of an outdated will or late-life will changes. Many people are unaware that marriage, remarriage, divorce, or separation are appropriate times (among other life events) for a new will or will update.

Many Canadians don’t have a will at all, which can leave the division of your estate to government rules. This could be the opposite from what your family was anticipating, and the resulted estate dispute isn’t strong without a will to interpret.

2. Family Law

Some Executors get an ugly surprise when they find out that the estate is still owing child support, alimony, or promised reparations. Death does not excuse you from family law obligations – it simply passes them on to your executor, who is typically a family member.

Don’t leave the burden of negotiating a settlement with an ex-spouse or estranged child to your loved one.

3. Administrative Errors & Conflict of Interest

Executors are personally liable for errors they make in administering an estate, that is why Executor Liability Insurance is so important. Many executors only fully realize this when they receive a letter from a lawyer about someone demanding money from the estate.

Or in some cases, there is an application to remove the Executor altogether due to errors or a conflict of interest.

4. Estate Liquidity Problems

In many cases estates are tied up awaiting probate, which means the Executor will have to cover the bills until the estate funds can be accessed. (What’s probate? A process required for accessing the estate bank and investment accounts and for transferring real estate titles.)

It can sometimes take months to collect the information, apply, and receive the court-prepared documents that are issued when the probate fee or estate administration tax is due.

In Ontario, the Estate Tax is approximately $15,000 per $1 million of estate value. This can be a huge financial burden for the executor, and they may have to find other ways to fund it (i.e. ask beneficiaries to contribute.)

5. Potential Lawsuits

Lawsuits that arise during the course of administration can be a problem for the executor and the beneficiaries of the estate.

Estate litigation legal fees can run as high as $800 per hour, so preventing the estate funds from being drained by potential legal costs and court outcomes is a real concern.

6. Family Dysfunction

Petty grievances, long-standing grudges, and conflicting personalities can all rise to the surface after the death of a parent or loved one.

It can make it very difficult for the executor to conduct their estate administration tasks, and the longer an estate takes to close, the higher the tension grows as beneficiaries wait for their inheritance.

One common family dispute is over personal items. The Executor must take inventory of all assets and repay all estate debts before giving out anything – money or otherwise – to beneficiaries. But family members often want a memento or personal belonging right away.

7. Executor Compensation

Executors are entitled to be paid by the estate for the work they perform. After all, the average estate can take two years to close – and that’s without any estate litigation disputes.

Being an Executor is often compared to having a part-time job, but often a thankless one as coming to an agreement with beneficiaries about a reasonable executor fee is often challenging.

If no one can agree, you may find yourself in court. For protection in such situations, you should secure Executor Liability Insurance.

8. Omitted Family Members

Sometimes there are family members excluded from the will or given a lesser inheritance, and this often incites legal action and should be considered a red flag.

If you are planning on omitting someone or making a specific decision in your will like giving one child more than another, please include a personal note of explanation with your will documents. It will make your Executor’s life a lot easier.

9. Undocumented Loans

Undocumented or poorly documented loans from the estate may require collection by the executor. This can become an estate litigation dispute quickly, as the legal obligation requires the executor to claim it, no matter their relationship with the borrower.

“Everyone who has loaned money from a parent will insist that it was a gift and not meant to be repaid. This can cause a problem if that isn’t what the will says.” – Scot Dalton, ERAssure CEO

10. Hyper Vigilant Beneficiary

The executor who has previously acted as Attorney for Property or Personal Care for the deceased person is often named as an executor of the estate. This is always a bit of a red flag, because hyper vigilant or skeptical beneficiaries may be suspicious of the executor’s previous role.

For example, were they managing the estate honourably as the Power of Attorney or with their own personal gain in mind?

We recommend if you act as a Power of Attorney or Executor to keep detailed records of every estate decisions that’s made, when it was made, who it was made by with their signature, and the reason. (Learn more about the dangers of late-life will changes here.)

How to Resolve Estate Disputes

If estate litigation disputes are so common in Canada, then how do we resolve them? You can’t 100% prevent someone from taking you to court, but there are things you can do as an Executor to reduce the risk:

- If you can, ask the testator or owner of the will to include a personal letter of explanation, specifically outlining any potential red flag areas like if there is existing child support, if a family member is omitted, if there are any outstanding debts and if they are to be repaid, etc. Leaving as little interpretation as possible in the will is critical.

- Keep a detailed record of all your decisions, tasks, and communications as Executor. Important things to note are communications with beneficiaries, payments made, debts repaid, important estate decisions made, real estate dealings, potential delays in estate closure, inventory of personal assets and their whereabouts, etc.

- Be as clear, cooperative, and communicative with your beneficiaries as possible. Many estate litigation disputes come from beneficiaries either as a result of a strained executor-beneficiary relationship, perceived estate administration mistakes, or issues with the will interpretation.

- Create a timeline of the expected estate closure and share it with the beneficiaries. Some may be very eager to receive their inheritance and frustrated with any delays in estate administration.

- Always have a legal professional assist in the interpretation of the will. This is a critical step in the process and a topic that produces many disputes. Review and gather the estate documents, make a plan for completing your tasks, and then review the will with your legal representation.

- Follow the Canadian Executor Guide to ensure you complete all of your tasks at the right time. Some of your duties will be timely, like taxes and applying for probate, while others may take longer, such as the sale of real estate.

- If it is possible, have the testator of the will review their estate plan with you so you are aware of things like where important documents are kept, who the executors and beneficiaries are and what they stand to inherit, and any specific decisions (for example, if there is a family cottage with multiple owners.)

How to Protect Yourself Against Estate Litigation Disputes

Securing Executor Liability Protection BEFORE a problem arises is the most important thing you can do to protect yourself as an Executor. But like all insurance, it will be much harder to secure once the estate turns spicy, as they say.

We typically recommend you apply within 30 days of becoming an executor. You can download an application here.

You can also include Executor Liability Insurance in your will ahead of time for your own Executors as an Estate Services Plan.

If you have any questions about securing Executor protection for yourself or a loved one, please reach out to our Team today.

More Estate Planning Questions?

Who should I choose to be my executor?

Can there be more than one executor of a will?

How can I protect my family and assets?

What is Executor Liability Insurance?

How can I prepare my child to be the executor of my estate?

Is there a preparation course for future executors?

How to Manage Cottage Co-Ownership

Is there a guide for executors?

What are my tasks as an executor?

Can I include my pet in my will?