Prepare Your Estate and Your Executor

Most Canadians choose their children as their executor, but they want to sleep soundly knowing their family member will have help with the complicated tasks involved.

No parent wants their child to pay out-of-pocket for expenses or spend time tracking down missing information.

So how do you prepare your estate so that the executor role is simple and safe for your family?

Five Steps to Prepare

Your Estate for Smooth Management

“It will take your executor about two years to close your estate and they can pay up to $15,000

Scot Dalton, CEO of ERAssure

in expenses while they wait for access to the estate funds.”

You can have a worry-free estate plan by following these five steps recommended by the ERAssure Team.

Let’s get started:

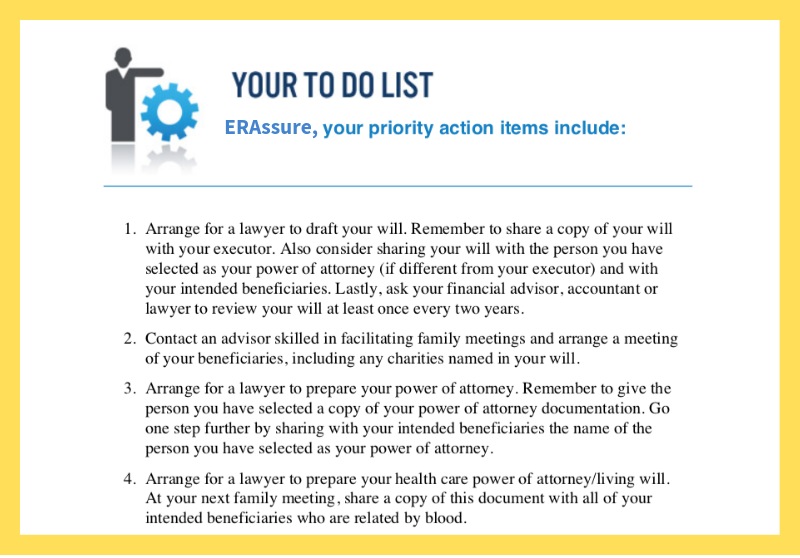

Step 1. Get Your Free Customized Estate Plan To-Do List

Complete the 10-minute Estate Plan Checklist from our partners at Willing Wisdom and get your customized to-do list of tasks that will reduce estate expenses and close gaps in your estate plan.

Regular Price: $200.00

Get it for free,

compliments of ERAssure.

Step 2. Complete Your To-Do List

Review your custom Estate Plan To-Do List and complete the recommendations to tie up any loose ends and reduce estate expenses.

Your custom to-do list will be available for up to 30 days, so remember to download and save it!

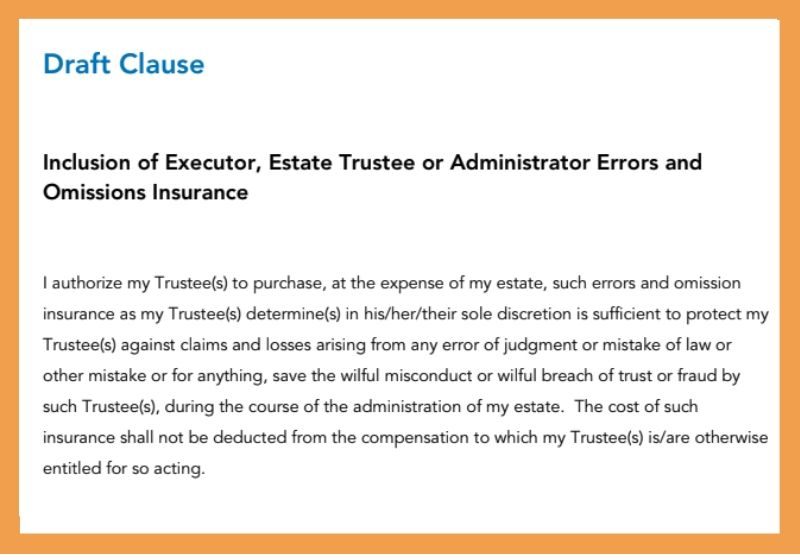

Step 3. Add an Estate Services Plan to Your Will

An Estate Services Plan provides important support services that will help your Executor complete their tasks. It also keeps them safe from the legal and financial liability that comes with the role.

Request a free quote here and our team will reach out to discuss your plan options. Once you’ve selected your plan, you’ll add a clause like this example to your will to finalize.

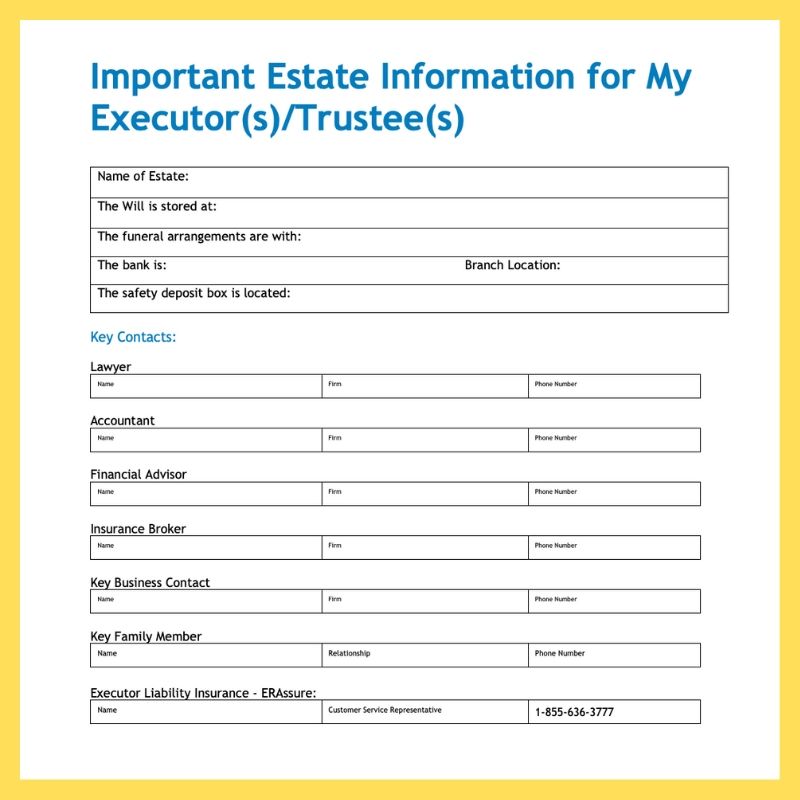

Step 4. Collect & Review Information

Collect your important estate information using our Estate Information template and review it with your family members.

Make sure your executor has this information as well, because it will save them a lot of time and frustration chasing down passwords and contacts.

Step 5: Share Executor Resources

Download this free guide to include with your Will. It includes important information and instructions that will help your Executor complete their tasks without mistakes.

Feel free to save and use any of our free estate planning resources, such as:

And that’s it!

What is an Estate Services Plan?

An Estate Services Plan includes important support services that make your executor’s job easier.

Your Estate Services Plan gives your executor:

- Practical executor tools

- Professional assistance reviewing the will

- Assistance filing documents that require immediate completion

- Access to Notice to Creditor Tools

- Executor Compensation

- Final Expenses (i.e. Funeral)

Canadians of all ages and health statuses are eligible for an Estate Services Plan. Find out how you can apply for a free quote today.

More questions about Estate Services Plans?

Speak to our Team today at 1-855-636-3777 or fill out the form below to book your free consultation

Looking for Answers?

Why should I get an Estate Services Plan?

Canadians are including Estate Services Plans in their wills so they can rest easy knowing their family and executor are safe and have support completing the complex estate administration tasks. If you’re worried about leaving your estate to your family, ask us about how you can protect them today.

Is making my child my executor a good idea?

It’s very common to name your children as your executor(s). It’s the simplest option most of the time, however, be aware it can cause extra tensions and disputes depending on family relationships. Learn who else you can name as your executor here.

What happens if my executor makes a mistake?

If an executor mismanages the task, they’re personally responsible to the beneficiaries, to the creditors and also to third parties that they might be engaged with during the term of the administration. An Estate Services Plan includes Executor Liability Insurance, which protects them against paying out-of-pocket for legal fees and mismanagement claims. Learn more about the risks of the role right here.

I’m just starting my will and Estate Plan and need help.

You’re taking an important first step! We have free resources to make your estate planning and will preparation easy, like our Will Preparation Guide. Browse and download all of our free guides right here.

How do I know if I’ve done my estate planning right?

There are lots of details to think of when we put together an estate plan and Will, so it’s easy to overlook some things. That’s why you should use our 10-minute checklist to get your customized to-do list of tasks to ease your mind. The to-do list will help to reduce estate expenses and close gaps that may cause problems in the future. It’s usually $200, but you can get your to-do list free right here, compliments of ERAssure.

Need more help planning?

Continue Learning

Who should I make my Executor?

What is an Estate Services Plan?

Free Estate Planning and Executor Resources

What does it work with more than one executor?

How to make an Estate Plan for cottage co-ownership