Executor Preparation Course

Welcome to the Official Executor Preparation Course for Canadians!

This free one-hour course is here to help you prepare for being an executor. It’s a big job, but the more you know in advance the easier, faster, and less frustrating it will be when you finally step into the role.

How It Works

You’ll go through five lessons during the Executor Preparation Course that will teach you the terminology, your tasks as an executor, your financial and legal responsibilities, and your obligation to the beneficiaries.

You’ll also collect important information using the template in your Executor Preparation Package, a resource you’ll want to keep in a safe place for the future.

Executor Preparation Course Package

Before you get started, enter your name and email below and we’ll send you your free Executor Preparation Course Package.

The Lesson Plan

1.Executor Role and Responsibilities

3. Beneficiaries and Charities

5. Essential Estate Information

Final Test

Each lesson comes with a skill-testing quiz. Pass them all and you’ll earn your official course certificate and a free Executor Guide.

Ready to get started?

Each lesson and quiz should take about 10 – 15 minutes to complete. Let’s dive right in!

Remember to bookmark this page for easy access if you want to finish your course later or share it with a family member.

What is an executor?

The executor is in charge of administering the estate. This includes arranging the funeral, reviewing the will, identifying the beneficiaries, identifying and settling the debts of the estate, paying taxes, and distributing the estate to the Beneficiaries. Closing a typical estate in Canada typically takes about two years.

What are the tasks of an executor?

There is a very long list of tasks for an executor to complete, but some of the most important are:

- Selling real estate

- Making funeral arrangements (and potentially paying for it until estate funds can be accessed.)

- Collecting and distributing possessions according to the wills instructions

- Settling debts with creditors

- Reviewing home insurance

- Obtain keys to any owned property and consider changing the locks

- Collect passwords to social media accounts, subscriptions, email, telephone billing, etc.

- Reviewing taxes from the past six years

- Filing taxes for the current year, and perhaps prior years

- Communicating with beneficiaries

- Reviewing the will for special requests like organ donation or charitable giving

- Finding care for pets

What is my legal responsibility as executor?

The executor has a fiduciary duty to the parties to the estate. A fiduciary duty is a much higher standard of care and performance than is typically required in a non-fiduciary role, because it involves the management and distribution of money belonging to other parties.

The required standard of care is often much higher than a person might generally exercise in respect of their own personal business.

Do I have a financial obligation?

People don’t typically think about the role of executor as having a personal financial risk but nothing could be further from the truth.

It’s important that people understand they are effectively pledging their own personal assets against a significant loss of estate value if attributed to their negligence in administering the estate as the executor.

If you are asking someone to act as executor on your behalf, it’s equally important to understand the imposition.

The Do’s and Don’ts

- You cannot use estate funds for personal expenses.

- You cannot choose how items are distributed to beneficiaries.

- You cannot determine your own executor compensation fee.

- You cannot remove a beneficiary from the will.

- You can seek reimbursement for expenses related to your executor duties, like traveling out of town for funeral arrangements.

- You can be a part of the fee decision between beneficiaries and other executors.

FAQs

- What is a testator? The testator is a person who has made a will.

- What is a beneficiary?A beneficiary is a person or organization that is entitled to receive some advantage under a will, sometimes a gift of money or property or use of property.

- What is a creditor? A creditor is an individual or organization to whom an estate owes a debt.

- What is an estate? An estate is the total property (both real and personal) that is owned by the decedent immediately prior to death.

- What is a joint account? Joint account means a bank or investment account owned by two people, and which passes into the hands of the survivor upon the death of the other owner. Jointly owned real estate has a similar feature. Joint accounts or joint ownership will often allow bank and investment accounts to pass outside of probate.

- What is litigation? Litigation means the process of taking legal action by taking a case to court so that a judgement can be made.

- What does probate mean? Probate is the process whereby a court establishes the validity of a will. Courts may levy a fee for probate which many people call “probate fee” or “probate tax”, and which is based upon the value of the estate. Probate is usually required by financial institutions and provincial land registry systems in order to transfer bank and investment accounts and change title to property. In Ontario, the expression used for “probate fee” is Estate Administration Tax.

- What happens when there is more than one executor? Two or more people can act as joint executors of a will. In this case, they must make all decisions together and sign all documents and cheques. It can delay the process and increase disputes, but it can also divide the work.

TEST YOURSELF: QUIZ #1

What is an executor?

You're the executor! The person in charge of closing the estate. It's an important role, so understanding that it's a big responsibility is step one.

Who pays for the funeral arrangements?

The executor must pay for the funeral arrangements, but can be reimbursed by the estate once the estate bank account is established. Often the testator will make provisions for their funeral in their will, so the executor only has to carry out instructions.

The executor takes inventory of assets and chooses who receives them

Who decides who gets the family cottage? Dad's car? Mom's wedding ring? The executor does not get to choose who receives which assets - it is all done according to the will. That is why the reading and interpretation of the will is such an important step.

Both my sister and I are named executors - who is in charge?

Joint executors can be tough. When one or more people - usually children - are named executor, they must come to unanimous decisions and sign all documents together. It can slow down the process and closing of the estate.

What is a testator?

The testator is the formal term for the person who made the will. It is the owner of the estate you're closing.

You had to fly home to sort out the funeral arrangements. Is that covered?

Executors can seek reimbursement from the estate funds, if there is enough to cover them. You may have to wait until the estate bank account can be established.

What happens if the estate has unpaid debts?

Settling unpaid estate debts is one of the most important duties of an executor. You must use funds from the estate bank account to pay any outstanding debts BEFORE you give anything away to beneficiaries. If there are timely bills or debts that need to be paid off before the estate bank account can be set up, that might need to be paid for out of the executor’s pocket initially and reimbursed by the estate later.

What kind of debts are included?

A debt can be anything from an informal contract with a sibling that the testator borrowed money from to a line of credit with a bank. You’ll also have to pay for any regular bills that are sent to the deceased, such as:

- Mortgage payments

- Home insurance payments

- Condo ownership fees

- Cottage ownership fees, such as insurance and taxes

- Utility bills

- Subscription services (i.e. movie and music services)

- Car payments

- Car insurance

- Cell phone services

- Internet services

- Appliance or furniture payments

If you are paying out-of-pocket for any of these bills, keep a very detailed record of receipts and dates so you can be paid back from the estate once the account is accessible (which can take a few months in some cases.)

Some services you’ll want to cancel to avoid additional payments (i.e. subscription services) while others you may still need. For example, if you’ve decided to sell the family home you may want to continue to pay the utility bills to ensure heat and light for showings and avoid frozen pipe damage.

What if there are not enough funds to cover the debt?

A common roadblock to closing the estate is when the funds fall short of covering all debts. This is known as an insolvent estate. There are a few options for you as the executor in this case:

- You can liquidate certain estate assets and use the funds to pay off the debt. (Consult your lawyer and beneficiaries about which assets to use to keep it fair and avoid disputes.)

- Be sure to pay your creditors according to priority. There is an order you must follow: 1. Secured creditors (i.e. a bank), 2. Reasonable funeral and testamentary expenses, 3. Administration costs related to the estate, 4. A levy on dividends paid to secured, preferred and unsecured creditors, 5. Preferred creditors (i.e. a landlord), 6. and Unsecured creditors (i.e. a personal loan).

- If you do not pay creditors in the proper order, the executor could end up paying the bill for a lower-priority debt that was not supposed to be given priority.

- IMPORTANT: It’s highly recommended that you seek a legal professional with experience with insolvent estates and bankruptcy to reduce potential litigation issues.

Learn more about the priority of creditors in Canada’s Bankruptcy and Insolvency Act.

Do you have to notify creditors?

As we mentioned before, there are two types of debts: formal and informal. Informal debts, like a mortgage payment, are typically forwarded to the executor and can be paid for as they come in. A formal debt is a bit different.

If the estate must go through probate (which means the will must be presented to the court to prove it is genuine), then the executor is required to notify creditors of the testator’s passing. You’ll also want to set a deadline that all formal debts need to be submitted by, which is usually a four to six month window. This can only be done once probate is granted.

Can creditors dispute your decisions?

Yes. If a creditor has submitted a formal debt and you (along with your legal council) have reviewed it and decided it is not a legitimate debt, or that the amount owing is incorrect, the creditor can dispute this decision. This is a common area of estate litigation, so be sure to record when and why all decisions were made just in case. This is a good practice to protect yourself throughout your role as executor.

What if the testator owned a business with debt?

If the testator owned their own business, it adds a layer of complexity to the estate which typically requires additional assistance from financial and legal professionals. We highly recommend that you seek legal assistance in these cases.

The type and size of business dictates a lot about the situation. Typically for a larger company, a succession plan would be included in the will which would pass responsibility for the business management and decisions on to someone like a business partner or advisor. In a scenario where the testator was the sole employee and sole proprietor of the company, any debts of the company could become the responsibility of the executor. For example, bills for website hosting services, retail space rent, or outsourced work to a contractor would need to be paid by the estate.

TEST YOURSELF: QUIZ #2

My cousin is asking for the $1,500 my mom owed him. As the executor, I can repay any debt under $2,000 at my own discretion.

You cannot prioritize personal loans. You must repay creditors in the order of priority laid out by the government of Canada in the Bankruptcy and Insolvency Act.

The testator's utility bill just came in the mail, but the estate bank account isn't set up yet. Do I have to pay it?

Yes. As the executor, you need to pay for any informal debts (aka bills) that come in until probate can be approved and the estate bank account can be established. Keep a record of all of your expenses so you can be reimbursed later.

Mom's annual magazine subscription bill just came in. Do I pay it?

It's your job as the executor to not only pay for any informal debts or bills that come in, but also to contact third-party service providers or subscription services to cancel on behalf of the deceased. This includes everything from recreational activities to Canada Post.

Beneficiaries are always paid before any creditors.

Debts must always be paid prior to the beneficiaries. This is a very important step and can result in litigation if a creditor files a request, but there are no funds to cover it because beneficiaries were paid out first.

How do you pay debts if the estate has no funds?

Please select 3 correct answers

You should seek all three of these solutions to assist you with an insolvent estate. Find a legal professional with bankruptcy experience, discuss liquidating estate assets with your beneficiaries, and be sure to repay creditors in order of priority (do not play favourites!)

Who are the beneficiaries of a will?

The beneficiaries are any people, pets, or charitable organizations named in the will who will receive estate funds or assets.

As the executor, you are legally and financially responsible to the beneficiaries. Communicating with your beneficiaries and ensuring they are aware of your progress with closing the estate, paying debts, and selling any assets is extremely important.

In order to manage expectations, give your beneficiaries a timeline for when you expect them to receive their payment so they can plan accordingly.

Can a pet be a beneficiary?

Yes! It has become more common than ever to include provisions for your pet in your will. It’s already a responsibility of the executor to secure care for any pets, but funds could also be left towards their care (like expensive medication, vet bills, and grooming.) There are even several famous cases where pets were left considerable sums of money – millions of dollars – by their wealthy owners.

How does it work if a charity is named in the will?

Beneficiaries can also be charitable organizations named in the will, not just personal relations. They need to be notified and kept updated on the estate closure progress just like any other beneficiary. You should also note:

- Each charity has their own guidelines and specific requirements they must follow when receiving a posthumous donation. You will have to contact them to discuss their specific process – some will be more strict than others.

- You need to verify the charity by confirming their status in Canada’s registered charity database.

- The charity will monitor the accounting to ensure the donation or gift is not reduced due to unsubstantiated executor, accounting, or legal expenses.

- The charity has the right to ask questions, receive a copy of the will, know who is acting as executor, and the right to a court review of the accounts if they would like to file a dispute.

Can a beneficiary file a complaint about an executor?

Yes, this happens very often and is the most common cause of estate disputes today.

If beneficiaries feel you’ve mismanaged funds or assets, taken a beyond-reasonable time to perform tasks, or disagree with your interpretation of the will instructions, they can file a dispute.

That’s why it’s critical that you keep track of all of your decisions and actions as an executor – like a diary, with dates and people involved. You should also give progress updates to your beneficiaries letting them know changes to the closure timeline and potential obstacles.

TEST YOURSELF: QUIZ #3

Who is a beneficiary?

A beneficiary is any person, pet, or charitable organization named in the will who will receive funds or assets. This can include cash legacies, bequests of real or personal property, securities, interests in testamentary trusts, remainder interests in life estates, and all or part of the residue of the estate.

Mom left her wedding rings to my sister, but I'm the executor and I'd like them too. Do I have to give them to her?

You're required to follow the instructions left in the will exactly and are not allowed to make your own decisions about who gets what. If you really feel the will is unfair to you, you can contest it, but that requires filing an estate dispute.

What happens to Dad's two dogs now that he's gone?

You're now in charge of finding care for the dogs. You can either care for them yourself, find a family member or friend willing to take them, or put them up for adoption at the local shelter. Remember to check the will for any pet care provisions!

My siblings are insisting on taking some personal items from the estate that are of sentimental value to them. Should I let them?

No you can't. It is often difficult being the executor because you're dealing with people who are grieving and have sentimental attachment to many estate assets, but that does not entitle them to anything. You must take inventory of all estate possessions and keep them safe until you're at the stage in the estate administration where you can give them out. If someone else has taken something they shouldn't have, you will be on the line for it.

The charity named in my mom's will just asked for a copy of the will and an update on the estate proceedings. Am I allowed to share information with them?

Charities are considered beneficiaries in the will, and are therefore entitled to a copy of the will. They are also allowed to protect the value of their donation or "gift" by asking questions about the estate management. If you make a mistake that diminishes their donation, you could find yourself in court.

What is an estate dispute?

Dividing up sentimental heirlooms, selling the family home, and dealing with estate debts are all sensitive subjects that can cause serious conflict.

Unfortunately, estate disputes are a common occurrence in Canada. That means a dispute could be filed against the estate and as the executor, you will have to handle it. This is why being an executor is such an important role – you’ll have many legal and financial responsibilities.

Estate disputes can take years and thousands of dollars in legal fees to settle, delaying the closing of the estate and frustrating everyone involved.

What causes an estate dispute?

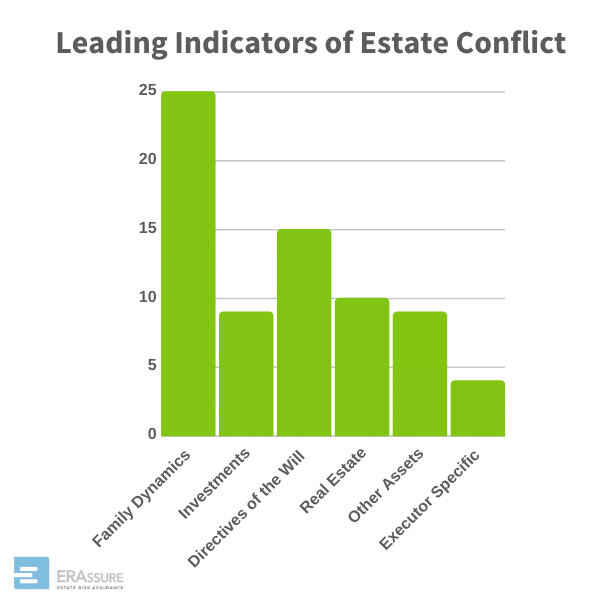

Estate disputes are one of the biggest liabilities when it comes to being an executor. There are five leading causes of executor conflicts in Canada: family dynamics, directives of the will, real estate, investments, other assets, and executor specific reasons.

Can an executor be removed?

Yes, an executor can be removed from their role.

A dispute can be filed against an executor if someone thinks they are not acting in the best interest of the estate or if they feel the executor is unfit for the role. For example, if the executor of the estate has dementia or a drug addiction.

How to Handle Estate Disputes

If you follow these best practices, you will be as prepared as possible in case of an estate battle:

- Keep an accurate record of all of your decisions, actions, and communications as executor with accurate dates, times, and names.

- Take an inventory of estate assets ASAP before allowing friends and family to remove items themselves. Store these assets appropriately until all estate debts have been settled.

- Follow the correct procedure for posting a notice to creditors and follow the proper order when repaying debts.

- Review the will and your plan for carrying it out with a legal professional.

- Make sure the will of the estate includes an Estate Services Plan to protect you legally and financially in an estate dispute. If it does not, you can look into securing Executor Liability Insurance yourself.

- Do not miss deadlines and be aware of time sensitive tasks.

- Keep beneficiaries up-to-date on any estate proceedings.

What is Executor Liability Insurance?

Executors need protection from the legal and financial responsibilities that come with the role. Executor Liability Insurance can either be included in a will as an Estate Services Plan, obtained by the executor, or pre-arranged by the testator while they are alive.

Having this protection in place means you won’t be paying out of pocket for legal fees or administrative mistakes you’ve made by accident. For example, if you miss a payment deadline causing the estate to pay a penalty fee and additional interest, you could be held responsible for that loss.

TEST YOURSELF: QUIZ #4

What is the leading cause of estate disputes?

Tense or non-existent family relationships are the #1 cause of estate disputes. The nuclear family is changing and blended families have become commonplace, but the introduction of more complicated dynamics has also increased disputes.

You've missed an application deadline and now have to pay a penalty fee plus interest. Is this cause for a dispute?

Yes. If a beneficiary feels you diminished the value of the estate due to a mistake, they can file a dispute against you.

You accumulated thousands in legal fees fighting an estate dispute. Who has to pay for it?

Please select 2 correct answers

If you do not have Executor Liability Insurance, you will be forced to pay for any legal fees associated with your estate litigation. In some older cases executors have used estate funds to cover legal fees, but that is being reconsidered.

An executor can be removed if they are deemed unfit for the role. True or False?

True. A dispute can be filed to remove an executor if there is reason to believe they are unfit, typically due to mental instability.

Your sister was left some jewellery in the will, but now it cannot be found. Who is responsible?

It is the executor's job to take inventory of all estate assets before anyone is allowed to remove anything from the estate. If something goes missing, you're on the line for it.

You finished your executor tasks two years ago but now a creditor is claiming they didn't get paid. Who is responsible?

As the executor, you are responsible for reopening the estate and proving that the creditor's claim is false.

Welcome to the final lesson!

You’ve learned the types of tasks you’ll do as an executor and some of the risks involved. Now let’s focus on the essential estate information that you’ll need to collect in order to perform your tasks.

We recommend you sit down with the testator of the estate and use your Executor Preparation Course Package as a fill-in-the-blank template to collect this information. It will be much easier for you to locate this list together ahead of time than by yourself later.

1. Estate Information

- Deceased’s Full Name

- Full Address

- Date of Birth

- Date of Death

- Passport Number

- SIN Number

- Employer

- Where the will is stored

- Who the funeral arrangements are with

- Bank and Branch

- Safety deposit box

- Executor and Co-Executor

- Spouse of the Deceased (if applicable)

2. Key Contacts

- Lawyer

- Financial Advisor

- Accountant

- Insurance Broker

- Key Business Contact

- Key Family Member

- Executor Liability Insurance Contact (1-855-636-3777)

- Power of Attorney (name, address, phone number)

3. Banking and Insurance

- Financial Institution (name, account type, account #)

- Insurance Information (company, agent, policy number, beneficiary, face amount)

- Investment Information (company, broker, account #)

- Pension/Annuity Information (company, date of deposit, amount)

4. Properties

- Address/Location

- Property Manager

- Mortgage Holder

5. Other Asset Information

- Type of Asset

- Key Contact

- Location (Address)

- Instructions

6. Login Credentials

- Online Banking

- Telephone

- Internet

- Social Media

- Utilities

- Music Subscription

- Streaming Services

If the testator of the will is also a business owner, that makes things more complex and adds several items to this list. Be sure you are aware of the succession plan for their business operations and the proper contacts that would assist with it. Legal council is strongly advised in these situations.

Now that we’ve gone over the estate essentials, you’re ready to take the final test!

Are you ready?

We’ve covered all of the basics of being an executor in Canada, now let’s see what you remember and what you don’t.

(PS, if you didn’t get your Executor Preparation Course Package at the beginning you’ll want to download it now because it’s full of important notes from the course for you to keep!)

Who is the testator?

The testator is the person who made a will.

True or False: joint executors can sign documents and cheques independently.

False, joint executors must co-sign all documents and cheques.

Mom left $50,000 to her dog, Snuffles. Do I have to honour it?

Yes, you must honour it but you can dispute it if you wish. That will require estate litigation and legal fees.

A charity was names as a beneficiary of the will and they sent a list of estate questions. Do I need to answer them?

Yes, a charity is permitted to ask questions, know who the executor is, and receive a copy of the will.

Your siblings insist the cottage should stay in the family. The will says it must be sold. What can you do?

Please select 2 correct answers

The executor could sell the cottage directly to a family member or they could file a claim and go through estate litigation to keep it in the family.

The estate doesn't have enough funds to cover all debts. What happens now?

You liquidate estate assets under the advice of a legal professional and start by repaying high-priority debts first. An executor only risks paying out-of-pocket when they make a mistake in the repayment process and are not insured.

Dad owned several rental properties when he passed away, who takes over his landlord duties?

The executor is in charge of informing tenants, redirecting their payments to the estate account, and either performing landlord duties themselves or using estate funds to hire a service to do it.

You've just become an executor and reviewed the will, but it does not include executor protection. What do you do?

Call ERAssure at 1-855-636-377 to begin your application for Executor Liability Insurance. We can also connect you with document services, legal professionals, financial advisors, and free executor resources.

Congratulations, You’re Done!

You’ve successfully completed the Executor Preparation Course! Now keep the estate information you’ve collected and your course package in a safe place for the future.

You should also download and bookmark our Official Executor Guide for Canadians. It walks you though all of your executor tasks step-by-step so that you complete them correctly and on-time.

More Estate Planning Resources

- The Official Executor Guide for Canadians

- How to Prepare Your Estate for Your Executor

- Will Preparation Guide

- Inheritance Planning Guide

- Find a Lawyer Tool

- How do I choose my executor?

- Cottage co-ownership solutions

- Passing of Accounts: How does it work?

- Reopening an estate

- What happens when there’s no will?

- What are joint executors?

- List of executor duties

- How to include pets in your will