“Horrific.”

“Nothing short of a nightmare.”

This is how both parties of a recent 7-year long estate battle described their experience to The Toronto Star.

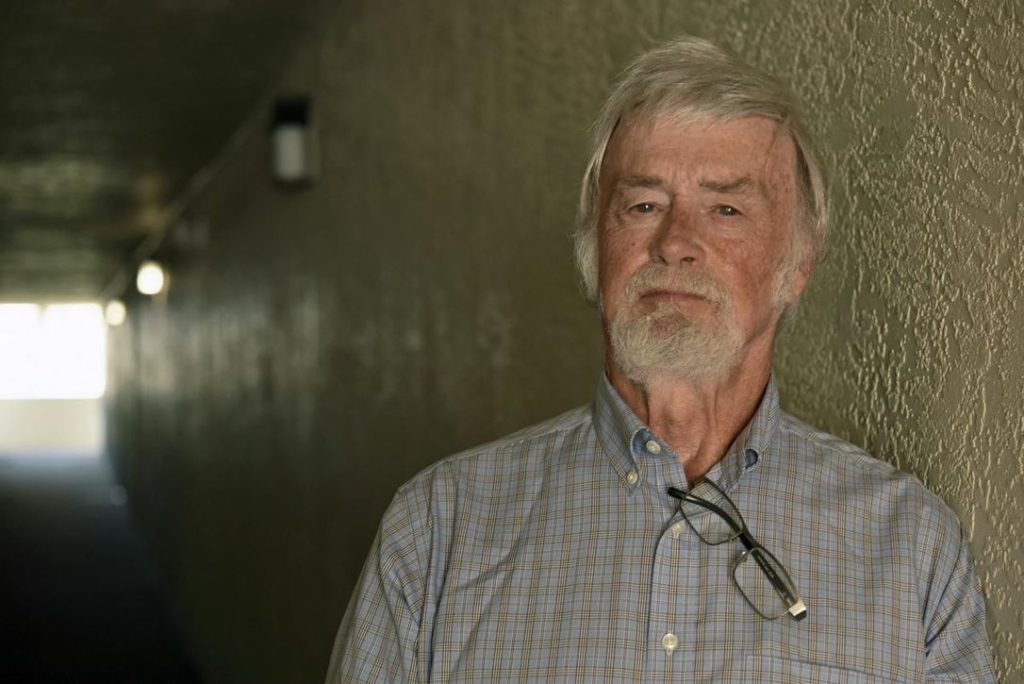

Terry Dooley, a semi-retired accountant from Toronto and the executor of the estate, was defending himself alongside the estate trustee against claims made by a relative of the deceased.

The cost of this estate battle totalled a combined $1 million in legal fees and seven years of their lives.

The Estate Situation

It can take up to two years to close the average estate in Canada, and that’s without any litigation issues.

If the estate has complications like multiple properties, assets in another country, a business succession plan, or questionable beneficiary requests (like we’re about to see), then it can make it even more time consuming, frustrating, and expensive.

“Many people don’t realize they have personal liability (as the executor).”

Melanie McDonald, Estate and Trust Expert

Terry Dooley, 73, says he foolishly accepted the role of executor of his friend and client’s multimillion-dollar estate. Here’s how he found himself in the middle of a lengthy estate dispute:

- The deceased was a 65-year-old Burlington businessman who was diagnosed with a brain tumour in 2010.

- He drafted a will leaving most of his estate to his second (common-law) wife.

- Martin then wrote a second will dividing his wealth among his common-law wife, friends, and business contacts.

- He did not include his daughter in his will because she had been taken care of financially through his separation agreement with her mother, the deceased’s first wife.

- He named two acquaintances his executors and estate trustees.

The Litigation Battle

Making late-life will changes is rarely an advisable decision, but sometimes it is unavoidable when unexpected situations arise.

In this case, it triggered a dispute with the deceased’s daughter who was excluded under the new will:

- The protracted court battle started in 2011

- The deceased’s daughter contested the will, saying that her late father had “lacked capacity … (and) suffered from delusions,” causing him to disinherit her

- The judge sided with the daughter and awarded her the entire $7.5-million estate

- Dooley and the estate trustee were personally responsible for her legal bills, in addition to their own legal expenses

- Dooley paid $100,000 to successfully refute accusations against him of having “undue influence” over the deceased, bribing a witness and misrepresenting facts, among other claims.

- The estate battle ended in 2018 leaving Dooley and the trustee to pay out-of-pocket for a combined $1 million in legal costs

The Damages

All parties involved in the estate dispute were left with costs and damaged relationships. There was no winner.

- The executor never received any of his $375,000 executor compensation

- False allegations during the trial hurt the executor’s reputation (even though he was found innocent)

- The deceased’s daughter said her experience was “nothing short of a nightmare” and marked by acrimony, attempts to “disparage” her character and diminish her relationship with her father

Will Estate Disputes Become More Common?

An aging Canadian population means that more people will have to take on the role (and the risks) of being an executor.

“On average, every 10 minutes 6 Canadians die leaving more than $1.5 million to be inherited.”

Thomas Deans Ph.D., Willing Wisdom

What’s the Solution?

So if most Canadians will have to act as executors at one point in their lives, how can you avoid paying huge sums out-of-pocket for a mistake you didn’t even make?

1. Get Protection

Including Executor Liability Insurance in your estate plan not only protects your executor from paying out-of-pocket for litigation issues, but it can also provide them with professional resources to complete their estate administration tasks correctly.

“Get executor’s insurance to protect against personal liability in settling an estate, no matter how easy it looks.”

Terry Dooley, Executor of the Estate

Administrative mistakes are a very common cause of estate disputes for executors in Canada. The safest option is to arrange an Estate Services Plan in your estate plan ahead of time.

For executors who are working with an estate that does not include an Estate Services Plan, they can apply for Executor Liability Insurance to protect themselves.

2. Avoid Late-Life Will Changes

There is no way to 100% avoid estate litigation issues, but there are things you can do to reduce the risk of them happening.

Making late-life will changes can be tricky because of several factors, like remarrying, step-children, and questions of mental capacity, dementia, or Alzheimer’s.

If you do have to make late-life changes to your will, make sure you explain them to your family, beneficiaries, and especially your executor(s).

3. Choose Your Executor Wisely

Choosing the executor of your estate is one of the most difficult estate planning decisions you’ll have to make.

People often want to choose their children, but consider these questions before you do:

- Are your family relationships distanced or strained?

- Is your child responsible and organized enough to take on the task?

- Does your child have enough time to commit to the job?

- Would the workload be easier if you named both of your children as joint executors? (Do they live near each other and co-operate well?)

- Is there someone close to you who would act as a better unbiased judge?

Remember to consider the age of the person you are naming as executor and to always pick a backup executor.

More Estate Planning Questions?

- I’ve just been named an executor – what now?

- How do I choose my executor?

- What are joint executors?

- What are my executor tasks in Canada?

- Who gets my estate if I don’t have a will?

- How do I prepare my estate for my executor?

- What is executor insurance?

- Can I include pets in my will?

- Should I make a late-life will change?

- Is there a step-by-step guide for executors in Canada?

- How can I prepare to be an executor?

- Who will inherit our family cottage?

- Can I sell estate property to family members?

- How do I include digital assets in my estate plan?

- What does “passing of accounts” mean?