Executor Liability Insurance

Protect Yourself From Estate Risks

Estate Risks are circumstances that existed before or developed following someone’s death.

They can often increase the likelihood of estate litigation because they:

If an estate dispute arises and you do not have protection through an ERAssure Executor Liability Insurance policy, you could end up paying thousands of dollars out-of-pocket for compensation, legal fees, and other expenses.

Why do I need Executor Protection?

Every family is unique and presents a specific situation that can make them vulnerable to certain Estate Risks. Our Team at ERAssure have seen many causes of estate disputes, but the following are the most common for Canadians:

Will Discrepancies

Wills that don’t reflect the realities of the family situation are a common Estate Risk.

This is usually the result of an outdated will or late-life will changes. Many people are unaware that marriage, remarriage, divorce or separation are appropriate times for a new will to be prepared or an existing will to be updated.

Family Law

Family law – governing marriage, divorce and child support – can be a surprise to beneficiaries when a loved one has left loose ends in terms of spousal or child support obligations.

Some people – perhaps many – wrongly believe that death will allow them to escape family law obligations. An unfortunate estate executor may have to try to negotiate settlement of these obligations with an uncooperative ex-spouse or estranged child.

Administrative Errors

Executors are personally liable for errors they make in administering an estate.

Many executors only learn of this when they receive a letter from the lawyer of an unhappy beneficiary or excluded family member demanding money.

Executor Compensation

Executors are entitled to be paid by the estate for the work they perform. The time and effort to complete estate administration is usually greater than executors ever expected, yet this work is often given little or no value by the beneficiaries.

The agreement between beneficiaries to a fair executor fee can be difficult; it sometimes results in hard feelings even after the distribution of assets. Sometimes, these matters end up in court like with this Toronto Executor.

Estate Liquidity Problems

In many cases, estates are tied up awaiting probate. Probate is a process required for accessing bank and investment accounts and necessary (in most cases) for transferring real estate titles to someone other than a spouse or other joint owner.

Many executors are forced to temporarily fund the expenses of the estate personally, including the funeral and payment of estate tax.

Potential Lawsuits

Lawsuits that arise during the course of administration can be a problem for the executor and the beneficiaries of the estate.

Estate litigation legal fees can run as high as $800 per hour, so protecting against the potential legal defense costs is an area that every executor needs to be aware of at the start of an estate settlement process.

Family Dysfunction

Some families have trouble getting along. Petty grievances that rise to the surface after the death of a parent can frustrate the executor’s efforts to conduct the affairs of the estate.

Not to mention slow-moving estates create even more tension among the family and beneficiaries.

Excluded Family Members

Sometimes excluded family members or those that have been treated differently in the will may initiate some legal action against the executors to gain some standing in the estate administration.

Undocumented Loans

Undocumented or poorly documented loans to beneficiaries may require collection by the executor. The executors may be legally obligated to resolve such matters, no matter how distasteful.

Hyper-Vigilance

The person who previously acted as Personal Caretaker and/or Attorney for Property for the deceased person is often named as an executor of the estate. This can often result in hyper-vigilance by beneficiaries that may be suspicious of the executor’s previous role as Power of Attorney.

What is Executor Liability Insurance?

Executors can be held personally liable for mistakes they make in settling an estate. If the beneficiaries suffer a loss, the executor may be required to reimburse the financial loss or cover the cost of the beneficiaries’ legal costs to collect.

Executor Liability Insurance protects against the costs of legal fees and restitution orders from a Court because the executor has made an unintentional error managing the estate, which impacted estate assets.

If you are now acting as an executor (or expect to be doing so shortly), we recommend you download an application for an ERAssure Executor Liability Insurance policy today.

This protection can be difficult to access if the estate has been open for some time or if there are problems that suggest a lawsuit is looming. It needs to be applied for as close to the date of death as possible. Not all estates will be eligible for coverage.

How to Secure Executor Liability Insurance

To arrange Executor Liability Insurance, download an application form or call our office at 1-855-636-3777 to speak with one of our licensed consultants.

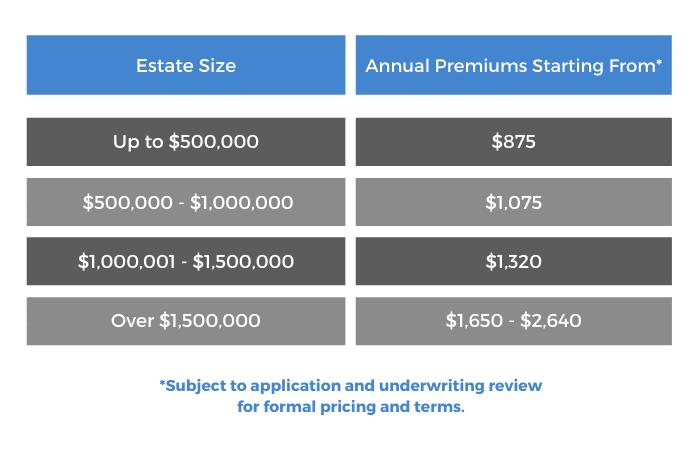

Sample Costs

CALL US WITH YOUR QUESTIONS AT 1-855-636-3777 OR FILL OUT THE FORM TO BOOK YOUR FREE CONSULTATION

Questions about being an Executor?

Who should I choose to be my executor?

Can there be more than one executor of a will?

How can I protect my family and assets?

What is Executor Liability Insurance?

How can I prepare my child to be the executor of my estate?

Is there a preparation course for future executors?

How to Manage Cottage Co-Ownership

Is there a guide for executors?

What are my tasks as an executor?

Can I include my pet in my will?