Executorship is Complicated

How Can We Help?

"I'm a legal professional helping

clients with Estate Planning.

What protection do they need?"

Need help now?

Call us at 1-855-636-3777 or book your free consultation:

What is an Executor?

An executor is the person(s) legally and financially responsible for carrying out a will. This includes many duties like settling debts with creditors, paying beneficiaries, making funeral arrangements, and finding care for pets.

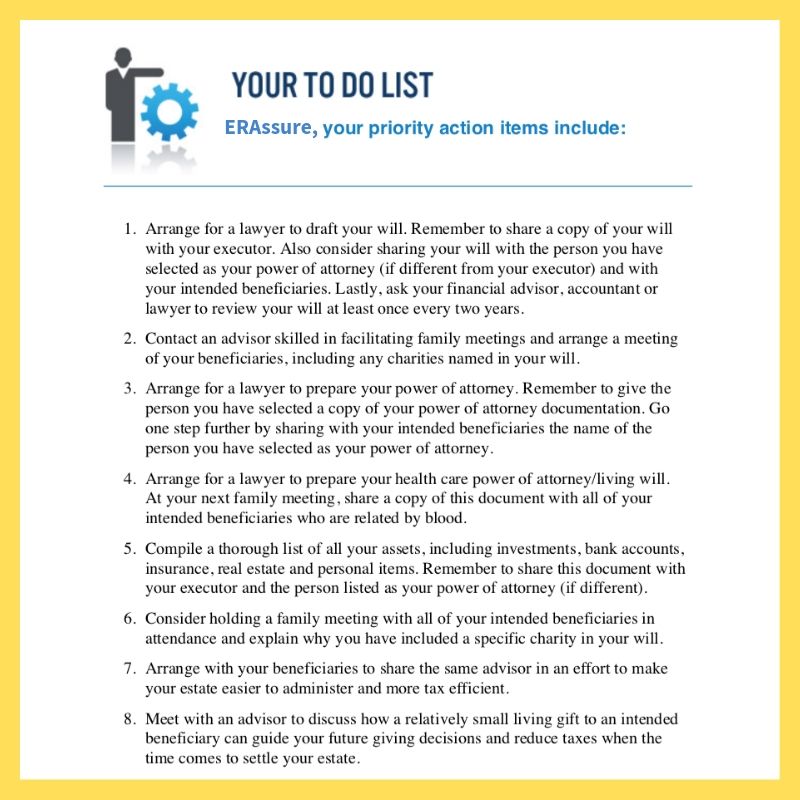

Your $200 FREE Estate Plan To-Do List

Created by the Willing Wisdom Index and provided compliments of ERAssure.

Is your estate plan worry-free?

Your Estate Plan should keep your family and your Executor safe. Whether you need protection today or for the future, you'll be able to rest easy knowing your family has a plan.

Protection for Today

Executor Liability Insurance gives you immediate protection

if you are closing an estate.

Planning for Tomorrow

An Estate Services Plan can protect the future of your

family, executor, and estate.